Email Us:

Call Licensed agent

Email Us:

Call Licensed agent

Ready for Reliable Retirement Income?

Indexed Universal Life

Envisioning Your Golden Years?

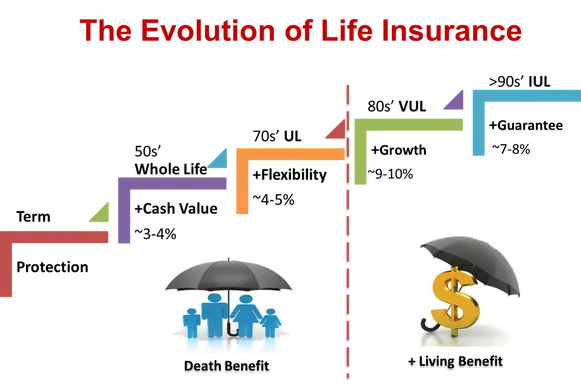

Life insurance has evolved significantly since 2000. Today’s policies offer more than just a death benefit—they’re versatile tools that can serve a variety of purposes. Imagine a life insurance plan that doubles as a retirement savings strategy, where your funds grow securely in an investment account that offers the tax benefits of a Roth IRA and the reliability of a traditional savings account. You can enjoy the growth potential of high-end variable accounts without the risk of loss.

Life insurance can also protect your business and key employees, provide living benefits, and cover catastrophic medical expenses that health insurance often doesn’t.

This isn’t your grandparent’s life insurance!

Insurance remains one of the safest and most regulated industries in the U.S., overseen by both state authorities and the SEC. Insurance companies are required to maintain triple the assets for every policy issued, ensuring unmatched stability. While other investment funds may fluctuate, a well-structured insurance policy with a reputable company offers unparalleled security—your money is safe.

Why Choose an Indexed Universal Life (IUL) Policy Over Traditional Insurance and Retirement Plans?

Review Your Retirement Portfolio and Goals

Share your retirement needs and aspirations with us, and discover how we can assist you in achieving them

Evaluating Your Financial Plan

Get a second opinion on your retirement strategy to ensure you're on the right track.

Explore IUL Options

Learn about the various IUL policies available and see if they align with your financial goals.

Indexed Universal Life (IUL): The Swiss Army Knife of Life Insurance. An Indexed Universal Life (IUL) policy is incredibly versatile, offering much more than traditional life insurance. It's designed to be customized to meet various financial goals, including retirement planning.

With an IUL, the cash value is allocated to a secure investment, such as an Index Fund. This means you benefit from the growth potential of premium index accounts, while still enjoying the security of cash value insurance.

Think of an IUL as a hybrid between a retirement plan and a life insurance policy. It allows you to participate in stock market gains without the risk of losing money.

An IUL offers a higher potential rate of return, making it a preferred option for growing wealth and securing retirement. The most popular indexes, like the S&P 500 and Nasdaq 100, are composed of the top-performing U.S. companies. As these companies thrive, so does your investment.

Plus, an IUL provides tax-deferred cash accumulation for retirement while maintaining a death benefit.

Additionally, IUL premiums are often more affordable than those of whole life insurance, offering a flexible and cost-effective solution for your financial future.

Why Working With a Broker is Better!

Working with a broker like G2 | Agency when buying an annuity offers significant advantages that can help you make a more informed and confident decision. Brokers have access to a wide range of annuity products from multiple insurance companies, allowing them to compare options and find the best fit for your unique financial situation and retirement goals. Unlike agents who may be tied to a single provider, our brokers work on your behalf, providing unbiased advice and ensuring you understand the complexities of each option. Their expertise can help you navigate the intricate details of IUL contracts, maximize your potential returns, and avoid costly pitfalls, ultimately giving you peace of mind and greater financial security in retirement.

Indexed Universal Life (IUL) insurance offers a unique blend of market-linked growth and life insurance protection, allowing you to build cash value while ensuring a payout for your beneficiaries. Like other universal life insurance policies, IUL accumulates cash value as you pay premiums. This cash value can be accessed if you cancel the policy or used as a loan for other financial needs.

IUL, also known as equity-indexed universal life insurance, allocates a portion of your premiums to annual renewable term life insurance, while the remaining funds are added to your policy’s cash value after fees are deducted. The cash value earns interest based on the performance of an equity index, credited either monthly or annually. However, it's essential to understand how IUL works before making a purchase.

Higher Return Potential: IUL policies offer the potential for higher returns, thanks to market-linked growth.

Flexibility: These policies provide flexible premium payments and the ability to adjust your coverage over time.

Tax-Free Gains: The cash value grows tax-deferred, and loans taken against the policy can be tax-free.

Return Caps: While IUL offers market-linked growth, there are often caps on returns, limiting the upside.

No Guarantees: Premium amounts and market returns are not guaranteed, which could affect the policy's performance.

Policy Cancellation: If you stop paying premiums, your IUL policy could be canceled.

IUL policies are generally best suited for individuals with significant upfront investments who seek tax-free retirement options and the flexibility to adjust their coverage. However, it's important to weigh the pros and cons to determine if IUL aligns with your financial goals.

We understand that choosing an annuity, IUL, or any financial product is a significant decision, especially when it comes to your retirement. It could be one of the most important choices you'll make. Ensure you have all the information you need to make a confident and informed decision.

Pays off your mortgage in the event of death, disability, or critical illness. It ensures your family can stay in your home without financial strain, providing a targeted benefit that decreases with your mortgage balance, offering peace of mind and security

They provide guaranteed minimum returns linked to a stock market index, combining growth potential with stability. This ensures steady income and peace of mind for retirees.

These annuities can offer growth, but it's important to know what you're buying.

Term Life Insurance provides affordable coverage for a set period, paying a death benefit if the policyholder passes away during the term. It's a cost-effective way to protect loved ones and secure financial stability.

Covers funeral and burial costs, offering a simple and affordable way to ease financial burdens on loved ones. It ensures that end-of-life expenses are covered, providing peace of mind and financial protection.

Insurance that provides income protection if you're unable to work due to illness or injury. It replaces a portion of your income, helping you maintain financial stability and cover essential expenses during recovery.

Offers financial support if you're diagnosed with a severe illness, such as cancer or heart disease. It provides a lump-sum payment to cover medical expenses and living costs, easing the financial burden during a challenging time.

Ensures a stable income during retirement by safeguarding your savings from market volatility and unexpected expenses. It helps maintain financial security and provides peace of mind, allowing you to enjoy your retirement without financial worries.

Provides early financial protection for children, offering benefits like savings for future education and coverage for unexpected health issues. It’s designed to give families peace of mind and secure a financial foundation for their child's future.

Promotes strategies focus on eliminating debt and building financial security. By managing and reducing debt, you can achieve financial freedom, enhance your savings, and create a more stable and stress-free financial future.

Todd Gorman

License No: 0C72954

NIPR: 3146641

4883-B Ronson CT, San Diego, CA 92111

G2 | Agency ©2025

Not affiliated with the U. S. government or federal Medicare program.

We do not offer every plan available in your area. Any information we

provide is limited to those plans we do offer in your area.

Please contact

to get information on all of your options. ( TTY 1-877-486-2048 )

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer